To qualify for benefits through the Supplemental Security Income or SSI program, a child must be disabled or blind and must meet strict income and resource limitations. When applying for benefits on behalf of your child, keep in mind that the Social Security Administration takes your assets and income into account. What you own and […]

Each year, the Social Security Administration (SSA) adjusts the income limits and benefit payment amounts to account for increases in the cost of living. The Supplemental Security Income (SSI) program is our focus in this blog, and we’ll go over how these increases affect your SSI. At Scully Disability Law, our attorneys work to keep […]

Many people believe that anyone who qualifies for Social Security Disability Insurance (SSDI or SSI) benefit payments is eligible for some immediate health insurance coverage. Unfortunately, that is not the case. In this blog post, we’ll cover who receives healthcare insurance under SSDI or Supplemental Security Income (SSI), and when each person can expect to […]

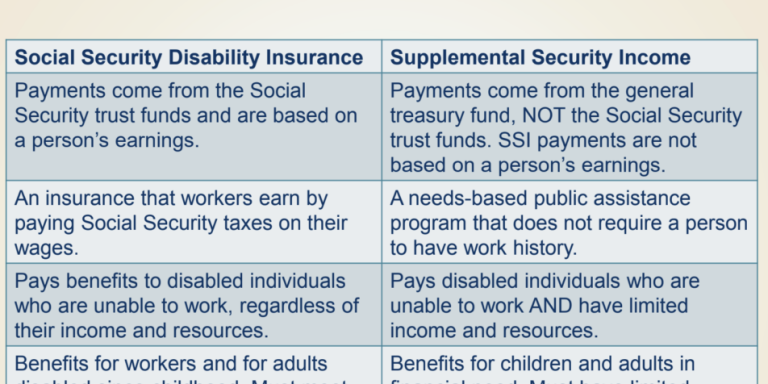

The Social Security Administration has two programs providing benefits to people with disabilities. Social Security Disability Insurance, commonly referred to as SSDI, and Supplemental Security Income or SSI offer monthly cash payments and other benefits to those who meet the qualifying standards federal law sets for each program. Although the monthly payments make the programs […]

After many years of extensive experience as Social Security Disability (SSD or SSDI) lawyers, specializing in helping disabled residents of Northern Indiana and the Chicago metro area, we know that many new clients have similar questions. At Scully Disability Law Office, we want every client to fully understand their own SSD benefits and how they […]

According to the Social Security Administration, slightly more than 7.9 million disabled workers receive an average of $1,280.98 a month in disability benefits through the Social Security Disability Insurance program. This is in addition to the almost 4.2 million disabled or blind adults and children who receive a Social Security disability benefit through the Supplemental […]

Qualifying for Social Security Disability (SSD or SSDI) benefits means you met the government’s definition of a disabled worker because you suffer from any medically determinable physical or mental impairment that prevents you from performing a substantial gainful activity, what they call an “SGA.” What is an SGA? — The SGA is a monthly income […]

If you are disabled or blind, you may qualify for Social Security disability benefits provided you also meet financial requirements established for the Supplemental Security Income and Social Security Disability Insurance programs administered by the Social Security Administration. The amount that you may be eligible to receive each month in benefits depends on the program […]

Waiting for a decision on a Social Security disability claim can be excruciating for someone experiencing financial pressures from being unable to work because of a disability. It is only natural to be anxious and want to know the status of your application or appeal. Checking on the status of your claim does more than […]

The vast majority of initial claims for disability benefits through either of the two programs administered by Social Security receive a denial notice. Should yours be one of an average of 21% of initial applications that are approved, maintaining eligibility can be challenging given the complex regulations and rules governing Social Security disability benefits. The […]