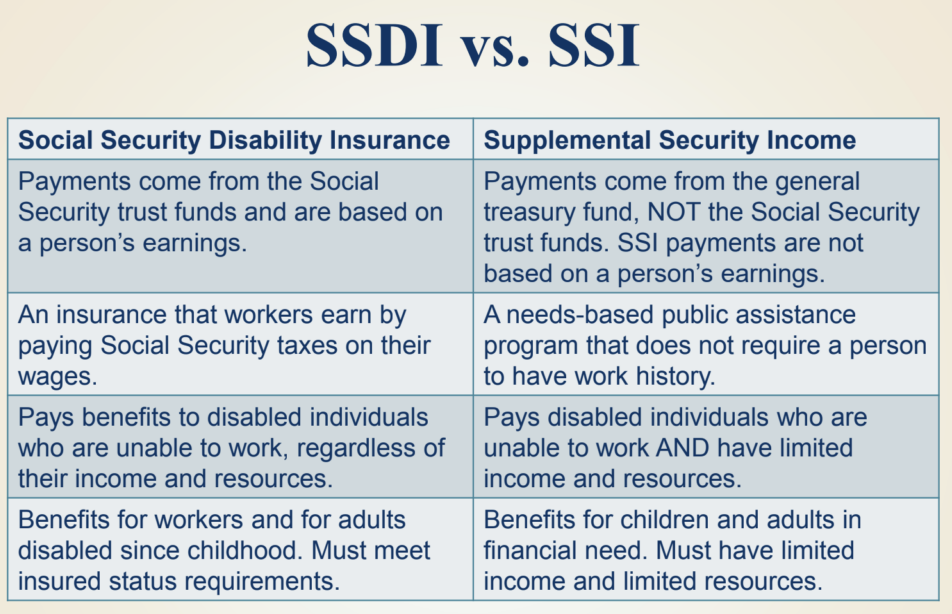

The Social Security Administration has two programs providing benefits to people with disabilities. Social Security Disability Insurance, commonly referred to as SSDI, and Supplemental Security Income or SSI offer monthly cash payments and other benefits to those who meet the qualifying standards federal law sets for each program. Although the monthly payments make the programs appear to be similar, they are quite different.

A better understanding of the two programs, including the qualification standards and benefits of each one, can be achieved by taking a closer look at the difference between SSI and SSDI. After reading through the information provided in this article, a Social Security disability lawyer at Scully Disability Law can help you through the application process for either program.

What is SSI?

The SSI program provides financial assistance to people with limited income and resources who are 65 years of age and older or blind or disabled regardless of age. If you meet the standards to qualify for SSI benefits provided by the federal government, you may also be eligible for supplemental benefits paid by the state where you live.

As a need-based program, SSI imposes limits on income and the value of assets or resources you may own and qualify for benefits. Generally, you may not have resources with a total value of over $2,000 as an individual or $3,000 for couples when both spouses qualify for SSI. There are, however, exceptions.

For example, the value of a home that you own and occupy as your principal residence is excluded from the resource limits. However, it counts as a resource when you stop living in it. There are exceptions, so get advice from an SSD lawyer at Scully Disability Law about anything that may affect your eligibility for benefits

What is SSDI?

The SSDI program is similar to SSI in providing benefits to individuals who are blind or disabled, but it differs by not being need-based or providing benefits based solely on the age of the applicant. That does not mean that everyone with a disabling medical condition who applies for SSDI meets the qualification criteria.

To qualify for SSDI, you must be “insured,” which means you made contributions to the Social Security trust fund by paying Social Security taxes on the income earned by working at a job or through self-employment. You must have worked long enough to earn a sufficient number of work credits to be insured and eligible for Social Security disability through SSDI.

You receive one work credit for every $1,470 in 2021 earnings that are subject to payment of Social Security taxes. A maximum of four credits may be earned each year. The amount of covered earnings to receive one work credit increases in 2022 to $1,510.

The number of work credits, which the Social Security Administration also refers to as “quarters of coverage, that you need to qualify for SSDI depends upon the age at which you become disabled. The older you are when applying for SSDI, the more quarters of coverage are needed to qualify for benefits.

How is a disability determined through SSI and SSDI?

The SSA uses the same definition of disabled for applicants under its SSDI program and adults applying for SSI benefits. A disability is defined as an inability to engage in substantial gainful activity caused by a medically determinable physical or mental impairment or combination of impairments. The impairments must be expected to cause death or to last for a continuous period of at least 12 months. A temporary disability that qualifies for benefits through a state-administered disability program would meet the federal definition.

Social Security applies a different definition of disabled to applications submitted on behalf of children younger than 18 years of age. To qualify for SSI benefits as disabled, a child must have a medically determinable physical or mental impairment or combination of impairments causing marked and severe functional limitations. The impairments must be expected to cause a child’s death or be expected to last for at least 12 continuous months.

SSI and SSDI have different health insurance coverages

If you qualify for SSI, you receive health insurance coverage through Medicaid. Medicaid is a program funded by the federal and state governments. Title XIX of the Social Security Act gives states authority over Medicaid eligibility guidelines and services that it covers.

SSDI beneficiaries generally do not qualify for Medicare coverage until they have received monthly SSDI payments for 24 months. Once you become eligible, you are entitled to Medicare Part A, which is hospital insurance. You have the option of obtaining supplementary medical insurance coverage, which is Medicare Part B, for an additional premium.

Part B premiums may be deducted from your monthly SSDI payments. Depending on your monthly income, some states provide financial assistance if you cannot afford the Medicare Part B premium.

Learn more about your SSI and SSDI options

An SSD lawyer can review the eligibility criteria, benefits, and other aspects of the SSI and SSDI programs to help you determine which program is best for you. To learn more and to schedule a free consultation, contact Scully Disability Law today.