The vast majority of initial claims for disability benefits through either of the two programs administered by Social Security receive a denial notice. Should yours be one of an average of 21% of initial applications that are approved, maintaining eligibility can be challenging given the complex regulations and rules governing Social Security disability benefits.

The information that follows provides a general overview of important things to know when you get Social Security disability benefits. It, along with help from a knowledgeable and skilled SSD lawyer at Scully Disability, can prevent termination or reduction of benefits resulting from being unfamiliar with how Social Security disability benefits work.

Financial rules continue after approval

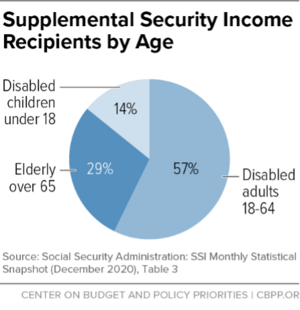

If you receive disability benefits through the Supplemental Security Income program, keep in mind that the income and resource limits continue to apply even after approval of your application. Resources available to you cannot exceed $2,000 in total value as an individual or $3,000 for a couple.

These limits on resources do not apply to you if you receive disability benefits only through the Social Security Disability Insurance program. You may be depending on your financial circumstances, qualify for benefits through both the SSI and SSDI. A consultation with an SSI lawyer can determine the program and the financial eligibility criteria that apply to you.

How much will you receive, and when will payments begin?

If you applied for benefits through the SSDI program and received approval before being disabled for at least five months, your first benefit payment may be delayed. The first benefit payment through SSDI starts in the sixth month after the onset of disability. The SSI program does not impose a similar waiting period.

The monthly benefit amount through SSDI is calculated using your average lifetime earnings on which you paid Social Security taxes while employed or self-employed. If you believe your monthly benefit does not reflect the earnings you had over your lifetime, an SSDI lawyer can review your earnings record to determine whether Social Security correctly computed the monthly benefit.

Your monthly benefit through SSI is $794 for an individual and $1,191 for a couple in 2021. Annual cost-of-living allowances may cause the monthly benefit to change in January each year. Depending on where you live, you may also receive a supplemental payment each month from your state in addition to the federal benefit. Your SSI lawyer can help you to determine whether your state pays a supplement.

Reporting changes while getting Social Security disability

When you get Social Security disability benefits, you have an obligation to notify the Social Security Administration of any changes that affect either the amount you receive or your eligibility. Examples of changes that you must report include the following:

- Change of address.

- Travel that will take you outside the United States for 30 days or longer.

- Changes in your immigration or citizenship status.

- Confinement to a jail, prison, or another type of correction facility for longer than 30 days.

- Receipt or discontinuance of pension or annuity payments.

- Change in marital status.

- Receipt, discontinuance, or reduction of workers’ compensation or other public disability benefits.

- Improvement in your medical condition.

Changes in the income that you receive from other sources must be reported to SSA. This includes earnings from a job or self-employment. If your disability makes it necessary for you to pay for items or services to make it possible for you to work, you should report them to Social Security. The cost of the items or services, such as medications, medical devices, and transportation, may be taken into account when computing monthly income from other sources, particularly for someone working under a work incentive program while on SSDI or for individuals working while on SSI.

When do Social Security disability benefits end?

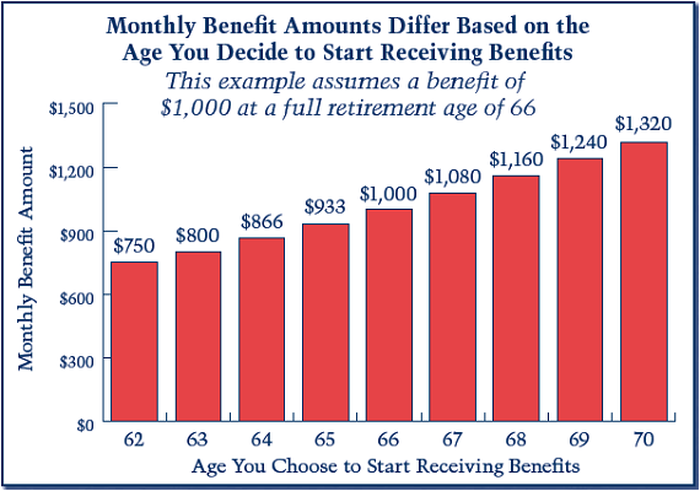

If you receive benefits through SSI, you remain eligible for as long as you are disabled and meet the financial limits of the program for income and resources. Benefits received through SSDI are paid from the Social Security Trust Fund. As a result, SSDI benefits convert to Social Security retirement benefits when you reach full retirement age. Unless you opted for early retirement at age 62, there should be no change in the amount of the monthly benefit when the conversion automatically takes place.

The age at which you reach full retirement is based on the year you were born. Anyone born in 1960 or later reaches full retirement age at 67 years of age.

Get help with Social Security disability

Whether you need help with an initial application for benefits or received a denial and must file an appeal, an SSD lawyer from Scully Disability can help. Contact them today for a free consultation to learn more about your Social Security disability benefits.